All Roads Lead to Churchill

LENDER FINANCE

Senior secured lending to originators and owners of residential mortgages.

Churchill’s Lender Finance business operates as a senior secured lending platform that specializes in offering debt solutions to originators and owners of residential backed mortgages. Launched in July 2020, the Lender Finance platform was established to capitalize on the substantial lending potential in a fragmented market, delivering an all-inclusive solution for originators and aggregators of investor purpose single family, condominium, multifamily, townhome and build-to-rent property loans. With a history of rapid growth, the business now boasts a portfolio of over 100 facilities, amounting to more than $10.2 billion outstanding (as of January 2025), making it a significant player in the lender finance sector.

RESIDENTIAL TRANSITION LOAN

Business purpose loan originations via direct and third-party origination channels with a core focus on short-term bridge residential transitional loans (RTL) and long-term investor purpose rental loans (DSCR).

Churchill’s RTL (Residential Transition Loan) business operates as an origination and aggregation platform with a strategic focus on the burgeoning demand for rehab loans, bridge loans, and ground-up construction loans. With a diversified investment approach, Churchill seeks to leverage the scarcity of housing supply and evolving demographic patterns to harness the opportunity in the short-term residential lending space across the United States. Since 2019, Churchill’s RTL business has originated more than $5.6 billion of RTL and DSCR loans.

TECHNOLOGY

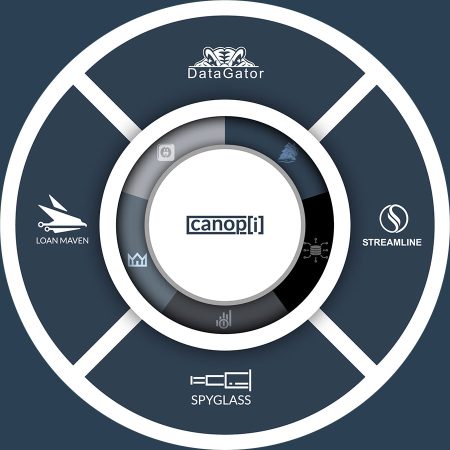

Churchill has built a proprietary asset management technology platform that provides a significant competitive advantage and supports transparency for investors, partners, clients, and employees.